CuriouSR #3 | Being a Woman Entrepreneur

article • Investment Management

Soumya Rajan

2025-08-29 | 10 MINUTES

It was a quiet Saturday evening with my family when my phone buzzed with congratulatory messages. Fortune India had published their 2025 edition of the 100 Most Powerful Women in Business in India, and my name was on the list.

That moment brought an overwhelming sense of accomplishment. It is indeed very fulfilling to be recognised for your work, but it feels even more special to be part of a study that could inspire many more women to pursue entrepreneurship.

Over the past few weeks, post the celebrations and cheers, I started reflecting on the remarkable life of a woman entrepreneur. The email inboxes are flooded with invitations to panel discussions at big and small conferences. The meeting rooms, however, are still heavy with the weight of social biases and unspoken prejudices. With every achievement, there is a sense that you are paving the way for progress. Equally, with every failure, there is a fear that you will prove the naysayers right.

There’s much to discuss.

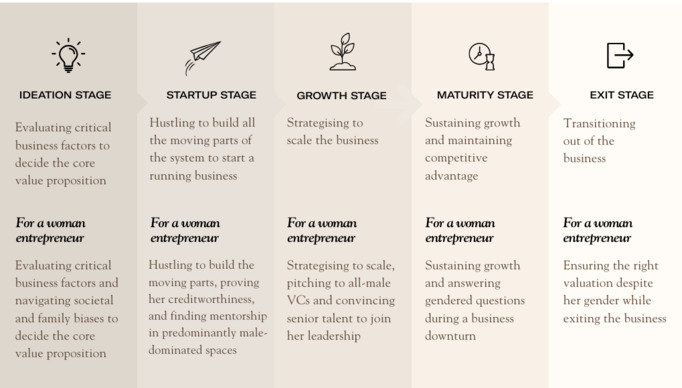

In this edition of CuriouSR, I am attempting to share what it means and feels to be a woman entrepreneur. I have tried to trace the entrepreneurial lifecycle of a woman and highlight, in each stage, the challenges and the opportunities unique to women. I also share my journey as a ‘Founder’ and highlight some measures that the system, as well as women, must take to strengthen the community of female business owners in India.

Hope you find it a thought-provoking read.

Running a business is not easy. Running a business as a woman in a patriarchal society is exponentially harder.

Despite that context, women contribute significantly to society’s economic and cultural growth through their businesses. I will break down the entrepreneurial lifecycle into 5 stages to visualise the above statement more clearly.

Stage 1 - The Ideation Stage

This is the stage of identifying the opportunity, measuring the demand, evaluating the market size, competition, capital requirement, and the growth potential. For a woman, at this stage, the above creatively challenging questions are accompanied by more mentally taxing ones -

- Am I capable enough of proving my doubters wrong? - There is a sense of self-doubt and development of impostor syndrome, owing to weak support, contrarian opinions, and few first-hand reference points to take inspiration from.

- Will my family and my partner’s family be okay with me committing to a business? - Societal expectations often make it harder for women to justify taking risks or pursuing an uncertain entrepreneurial path, especially when it clashes with family or societal roles.

- Will I be able to justify raising a child and managing the household along with running my business? - The responsibility of being primary caregivers (whether for children or elders) often falls on women, along with the management of the household, making it harder to devote time and energy to business ideation.

Societal expectations constrain the entrepreneurial prospects at the ideation stage itself.

As per a NITI Aayog report, women own ~20% of all enterprises in India. Of these, 82% are micro-units, run mainly as solopreneurs and in the informal sector, with no job security, lack of access to formal credit, legal protections, and broader markets.

Women’s ideas must be allowed to flourish.

They bring distinct insights into consumer needs, particularly in industries related to women’s health, education, family care, and lifestyle, creating niche opportunities and opening new markets. For example, FemTech, an industry which focuses on technology-based products and services aimed at improving women’s health and wellness, is expected to grow to $103 billion by 2030.

II. The Startup Stage

In this stage, the entrepreneur turns their idea into a real, working business. It’s a high-energy, fast-paced stage where the founder is constantly multitasking and adapting to new challenges. They are building the product/service, securing initial capital, creating a brand identity, handling sales & marketing, and streamlining processes. For women founders, a unique set of gendered obstacles and complexities comes along with this onerous phase:

- Will financial institutions consider me creditworthy enough to provide initial credit? - Banking and financial institutions often lack the sensitivity that reinforces the misunderstanding that women are not creditworthy, despite evidence suggesting that they repay diligently and do not default.

- Will my leadership abilities be respected, or will they be perceived as being soft, lenient, and lacking authority? - The perception about women’s leadership abilities stems from longstanding societal norms and cultural biases, and it can have a significant impact on their confidence, creating a self-perpetuating cycle.

- Will I be supported by mentors, peers, and industry networks - predominantly male-dominated spaces? - Women often face challenges in accessing mentorship and support in male-dominated environments due to a lack of representation and established networks.

Internalised biases have a domino effect; silent prejudices impact individual women entrepreneurs and further perpetuate the broader economic disparity. Female entrepreneurs received only 5.2% of the outstanding credit granted to enterprises by Indian public sector banks, and women-led businesses face an unmet credit gap of more than $11.4 billion, according to the

International Finance Corporation (IFC).

Women entrepreneurs need Patient Capital

With equal access to inputs, women-owned enterprises produce economic outcomes on par or even better than enterprises led by men. A BCG report discovered that despite receiving lower funds, women-led businesses generate more than twice as much per dollar invested as those founded by men. Patient capital will help women nourish their ideas into enterprises that formal financial systems will be willing to invest in.

III. The Growth Stage

Once the business has gained some traction and has started generating revenue, the next stage focuses on expansion and scaling the business. The problem statements start finding a structure, but they become increasingly complex, such as venturing into new markets, expanding the team, and most importantly, securing the next round of funding. To women, these problems feel a lot more layered -

- Will I be able to overcome systemic biases and prove my capability repeatedly to gain equal market opportunities and fair valuations during fundraising rounds? - Women entrepreneurs and the VC landscape have not had a very positive relationship so far. Globally, only 2% of all VC funding goes to women-founded startups. In India’s startup ecosystem, out of 8800 women-founded startups, only 2300 have been able to secure funding. (Tracxn)

- How do I navigate biases while hiring for leadership roles as a woman founder? - In most industries, leadership is traditionally male-dominated, and women founders may face resistance or biases regarding their ability to manage large teams.

Women-founded firms have a multiplier effect on the ecosystem.

A Bain report found that a focused effort on enabling women entrepreneurs to start up and scale could increase direct employment by 50-60 million people and increase indirect and induced employment of another 100-110 million people by 2030. Research also consistently shows that women reinvest most of their wealth into their families.

IV. The Maturity Stage

The business has achieved a certain stability, profitability, and market presence. The Founder’s focus is on sustaining growth and maintaining a competitive advantage. Their problems are now futuristic, such as innovating the products/services, diversifying revenue streams, and increasing their brand equity. Even at the helm, women leaders often find themselves working to dismantle lingering biases—both within their organisations and outside -

- How do I navigate the complexities of equity and compensation distribution with partners, co-founders, and early-stage employees without a bias against women? - Women, on average, earn less than men for the same amount of work. Despite established laws around equal pay, the deep-rooted patriarchy finds its way into corporate compensation structures.

- How do I deal with external pressures from investors, clients, or competitors who may question my capacity as a woman entrepreneur to lead and scale the business? - A downward performance cycle in a woman-founded organisation is often implicitly or sometimes explicitly attributed to the founder's gender.

Women open the door for more women to join leadership positions.

While 23% of employees in male-owned firms are women, the share of female employees is 42% in female-owned firms, based on a sample of more than 125,000 firms surveyed under the World Bank’s Enterprise Surveys. This increased representation helps bring in diverse perspectives and innovation which has been shown to enhance business performance and competitiveness in the market.

V. The Exit Stage

This marks the final phase of the entrepreneur’s journey, where the founder seeks to transition out of the business they have built. The founder has to make strategic decisions for the right way to exit, depending on personal goals, financial objectives, and market conditions. For a woman, this stage is still riddled with barriers that complicate the decision-making process:

- Will the value of my business be underestimated? - The market value of women-led businesses may be underestimated by an industry that is utterly male-dominated and where social biases persist even at the topmost levels.

Reports highlight that globally, merely among 1-2% of the businesses sold are women-founded, and they are valued 30% less than their male counterparts.

Women entrepreneurs are inspiring role models.

The case studies of large, successful, global businesses founded and run by women are still finite. Every single woman getting added to this list becomes an inspirational figure for a whole new generation of women. We need to support and cultivate these legacies with fair valuations, equal access and unbiased perspectives.

My Journey as a Woman Entrepreneur

I think the seeds of entrepreneurship are sown in the formative years. To even reach the ‘ideation’ stage discussed above, a woman needs to have a well-rounded understanding of how the various cogs of the global world order function. She needs to have received the education and gone through the experience that clears the first principles for her. She needs to have a support system that instils in her the confidence and the grit to think that she can add value to this world order, even if that means she has to disrupt some existing processes.

I do think that my journey is a case study about all of these factors working in sync to lead me to the ideation stage. Post that, you’re pretty much all on your own.

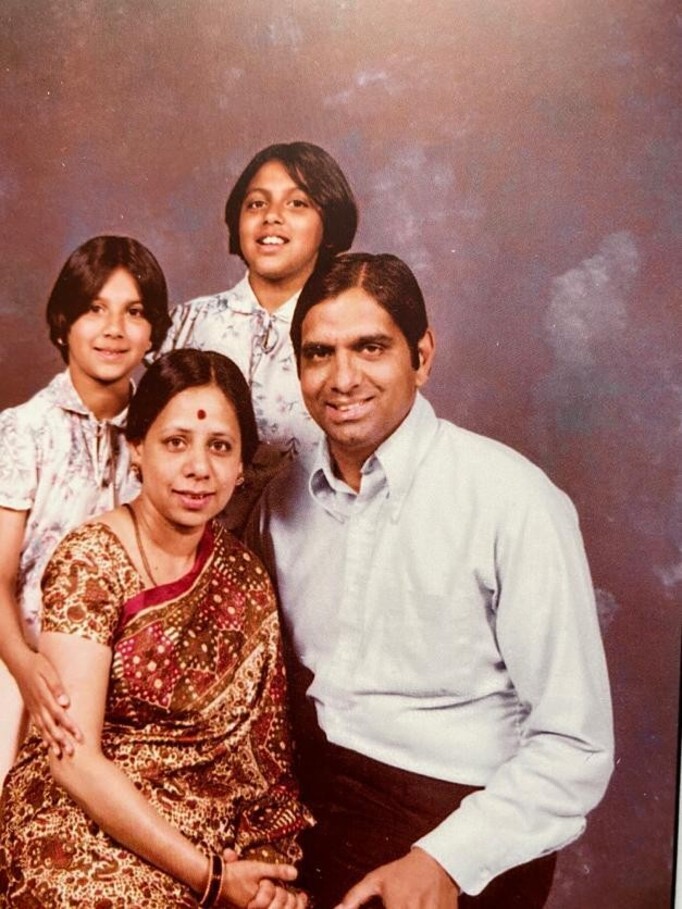

Growing up in a traditional upper-middle-class family, my father, a banker with the State Bank of India, had postings across various cities, including a significant stint in New York between 1975 and 1980. My mother, also employed with SBI and a trained classical musician, was fiercely independent and free-spirited—a true role model for my sister and me. We had a golden rule in our family -

If you educate a man, you educate an individual. If you educate a woman, you educate a family.

After completing my mathematics degree at St. Stephen’s College, Delhi, I pursued Mathematics further at Oxford University. In hindsight, studying Maths could have been seen as initial steps of going against the tide, disproving the stereotype that women are not good at Maths.

A strong educational background builds ambition and diminishes the impact of social biases. My thoughts after my education were immediately about the job opportunities I wanted to pursue and the career I wanted to build. Upon returning to India, I embarked on a 17-year banking career with ANZ Grindlays (later Standard Chartered Bank). By the age of 38, I was heading the bank's private banking division in India.

However, in 2010, I reached a crossroads. The global financial crisis had exposed systemic flaws in the wealth management industry, particularly the conflicts of interest inherent in commission-based models. I envisioned a client-centric, fee-only advisory firm that prioritized transparency and integrity. This vision led to the founding of Waterfield Advisors in 2011.

At that point, everyone told me I was doomed to fail.

But as an entrepreneur, your strongest suit is the belief in your vision. For me, this belief was driven further by the moral interest to do the right thing for the client and for the ecosystem. The initial years were challenging. Convincing clients to adopt a new model, building a team aligned with our values, and navigating regulatory landscapes required resilience and unwavering belief in our mission.

Support from my family, especially my husband, Mukund, was instrumental during this period. Together, we made lifestyle adjustments, invested our savings, and remained steadfast in our commitment to building a firm that would stand the test of time.

Pathways to Inclusivity

The rollercoaster ride of business cycles continues, from great quarters to challenging months, to tech disruptions, and the mighty fundraising process. The key takeaway for me from my journey and the journeys of most of the fellow women ranked as ‘Most Powerful Women in Business’ is a confluence of systemic, social and self-support. All of these factors need to work together to propel the spirit of entrepreneurship in women.

As someone who works closely with notable women entrepreneurs, is running a business herself and has gone through a fundraising round recently, I have observed some critical measures that the ecosystem needs to take to support women founders -

- Greater representation in PE VC firms - A major reason for the alarming 2% number (share of VC funding to women-founded startups) is the lack of women on the other side of the table, influencing these funding decisions. In the US, women comprised 18.4 per cent of investment decision-makers at VC firms in 2023, while in Europe, the share was 16%. In India, women's representation is minimal among the top 20 most active VC firms. Focused efforts must be made to increase these numbers. Communities like Winpe and Encubay are doing an incredible job of raising awareness. This is also one of the reasons why I strongly support women-founded funds—they hold the power to create a positive domino effect.

- Greater representation in boards of companies - In India, women hold just 18.67% of all board positions in listed companies. This dearth was so palpable that it was felt even by SEBI, which later mandated the appointment of at least one independent women director on the boards of listed companies. Having more women on boards can bring in different perspectives and shift the needle.

- Fostering more women-founder communities - Being a founder is a lonely journey. At any given time, the founder is trying to pull all the strings together for their belief. For a woman, it gets even lonelier because there are very few women-founder communities or network groups to discuss business-related problem statements. We are trying to build a women's community at Waterfield through learning sessions and networking events within our HERitage programme. We have witnessed its positive impact among the attendees, who gain valuable insights and have started to feel like a part of a community.

We also need change on an individual level. I strongly encourage women to improve their relationship with money and develop at least a basic understanding of financial concepts. Women’s financial independence does not equate to their financial literacy. A survey we conducted among high-net-worth women revealed that a staggering 60% of women were not actively involved in financial decision-making. This detachment stems from three underlying factors:

- The conditioning that financial matters are best handled by the husband, brother, or father, and

- The fear of being reprimanded for mistakes and of being judged for asking questions.

- Believing that managing money is a lower priority, in our complex, multi-tasking lives.

I firmly believe that true empowerment comes from agency and action.

I do see a change in the right direction as the newer generation of women start to take control of their wealth. They are getting involved in financial decisions, showing a propensity towards entrepreneurship, and investing in newer asset classes.

To women, I have 3 simple messages to convey -

- Don’t be afraid

- Take the time to educate yourself

- Spend time to understand and evaluate your life goals

The world will be forced to take note.

Warmly,

Soumya Rajan